Massachusetts residents to pay some of the highest lifetime taxes in the United States

A recent study titled ‘A Life of Tax: How Much Tax Will Americans Pay Over Their Lifetime?’ has revealed that residents of Massachusetts are among those who will pay some of the highest lifetime taxes in the United States.

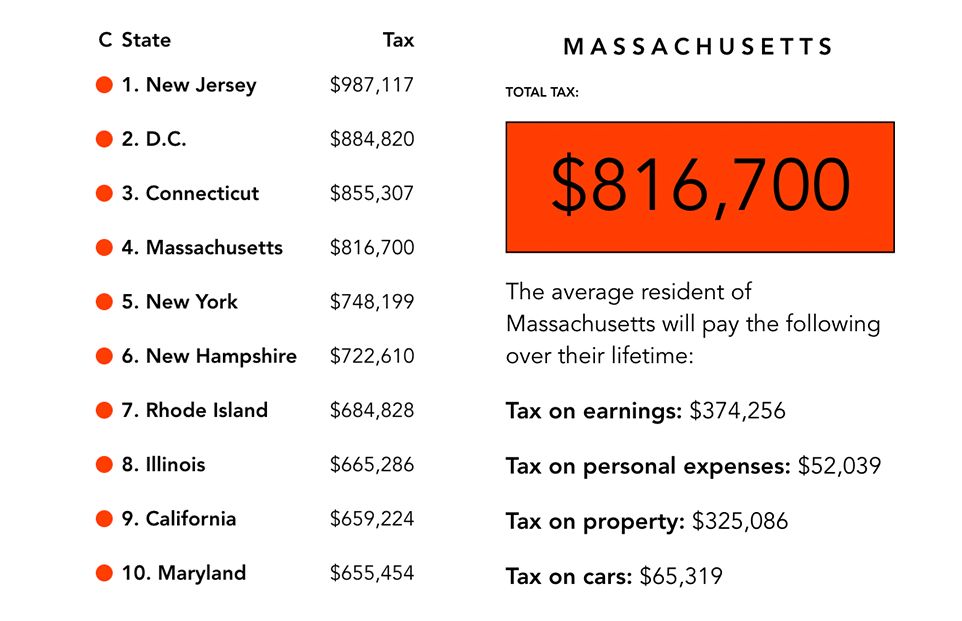

According to the study, the average American will pay approximately $524,625 in taxes throughout their lifetime, which accounts for about a third (34.7%) of their estimated lifetime earnings of $1,494,986. Massachusetts residents, however, are expected to pay even more, with a total lifetime tax burden of $816,700.

The study breaks down the taxes into different categories. For Massachusetts residents, the tax on earnings is estimated to be $374,256 over a lifetime. Additionally, tax on personal expenses, including food, clothing, personal care, and entertainment, is projected to be $52,039. Property tax will add another $325,086, and owning the most popular car (Toyota Rav 4) will cost an additional $65,319 in tax payments alone, across the average four cars owned in a lifetime.

These figures place Massachusetts as the fourth highest state in terms of lifetime taxes, following New Jersey, Washington D.C., and Connecticut. Residents of New Jersey are expected to pay the most, with a total lifetime tax burden of $987,117.