Standard & Poor’s Rating Service (S&P) has reaffirmed New Bedford’s AA- bond rating, and the City benefited from the rating with a very successful bond sale last week. The AA- rating, first awarded to New Bedford in January 2014, is the highest bond rating for the City in at least forty years, and moved New Bedford well into the top half of all issuers of municipal debt in the Commonwealth.

In its report, S&P cited a number of factors supporting the strong rating, including:

- Strong budgetary flexibility “due largely to management’s willingness to make the necessary budgetary adjustments to offset lower commonwealth and local receipts.”

- Favorable management conditions resulting from the Administration’s focus on improving financial management practices and the implementation of a series of financial management policies.

- Strong debt and contingent liabilities, with S&P noting that the City’s aggressive debt amortization strategy will result in the retirement of 72% of current outstanding debt in the next ten years.

- The City’s participation in a broad, diverse economy, coupled with its unique position to take advantage of the emerging offshore wind industry.

The AA- rating has had an ongoing positive effect on City finances. Investors reacted very favorably last week to sale of $7,948,000 in General Obligation Bonds; accepting lower interest rates than forecast, and saving New Bedford approximately $1.1 million in financing costs over the life-time of the debt, and the City has saved more than $1.5 million in financing costs over the lifetime of bonds issued since last year’s upgrade.

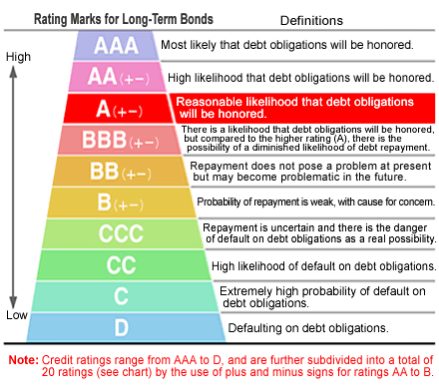

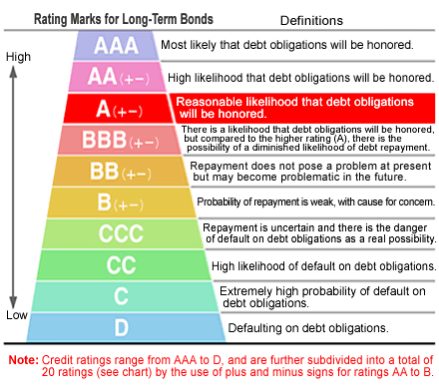

Credit agency ratings are utilized by investors to gauge the desirability of the City’s debt issues. The “AA- ” rating, the fourth highest rating on S&P’s scale, is the highest rating the City has received since at least 1970, and will continue to result in significant reductions to the City’s future debt service expenditures.

Mayor Mitchell summarized the impact of the recent bond sale, “This sale allows New Bedford to continue moving forward with much needed renovations and improvements. The reaffirmation of our bond rating is a vote of confidence in our approach to financial management. The verdict of Wall Street is clear: New Bedford is headed in the right direction.”

The City’s Chief Financial Officer, Ari Sky, noted the impact of the S&P rating on the City’s finances and overall reputation: “Only about 40% of Massachusetts localities and school districts hold a rating of AA- or higher, so the message is significant. New Bedford continues to experience favorable interest rates as a result, and the City’s marketability for economic development is similarly enhanced.”

The S&P report cited the City’s outlook as stable, stating that “New Bedford’s strong management environment will likely translate to strong budgetary performance and operating flexibility over the two-year outlook horizon. In addition, we expect New Bedford to maintain a strong debt and liability profile since debt service costs and net direct debt ratios should remain stable.”

New Bedford Guide Your Guide to New Bedford and South Coast, MA

New Bedford Guide Your Guide to New Bedford and South Coast, MA